Table of Contents

The introduction of return On Assets Formula

Before you invest in a company, knowing its net value after a year is essential. So, now how to do that? Return on assets formula can be quite hard if you lack experience. But don’t worry, We are here to help you with everything you need to know and get a better profit in the end. Our methods are helpful. These systems are still assisting companies to understand their chances in the investment market. That is why read the article to the end and get some added life lessons.

The Meaning of Return On Assets Formula

Return on assets is a ratio, telling you how much profit a company has gained from its resources and support. This sort of data bears an essential impact on a company’s investors. A company can achieve a high profit on investment. But, you can consider it a measure of using its resources and assets to profit. You can represent a return on assets as a percentage. Let’s say if a company’s Return On Assets gather 7.5%.

Return On Assets Formula

Return on assets formula means the company has made seven and a half cents per dollar.

The formula of ROA

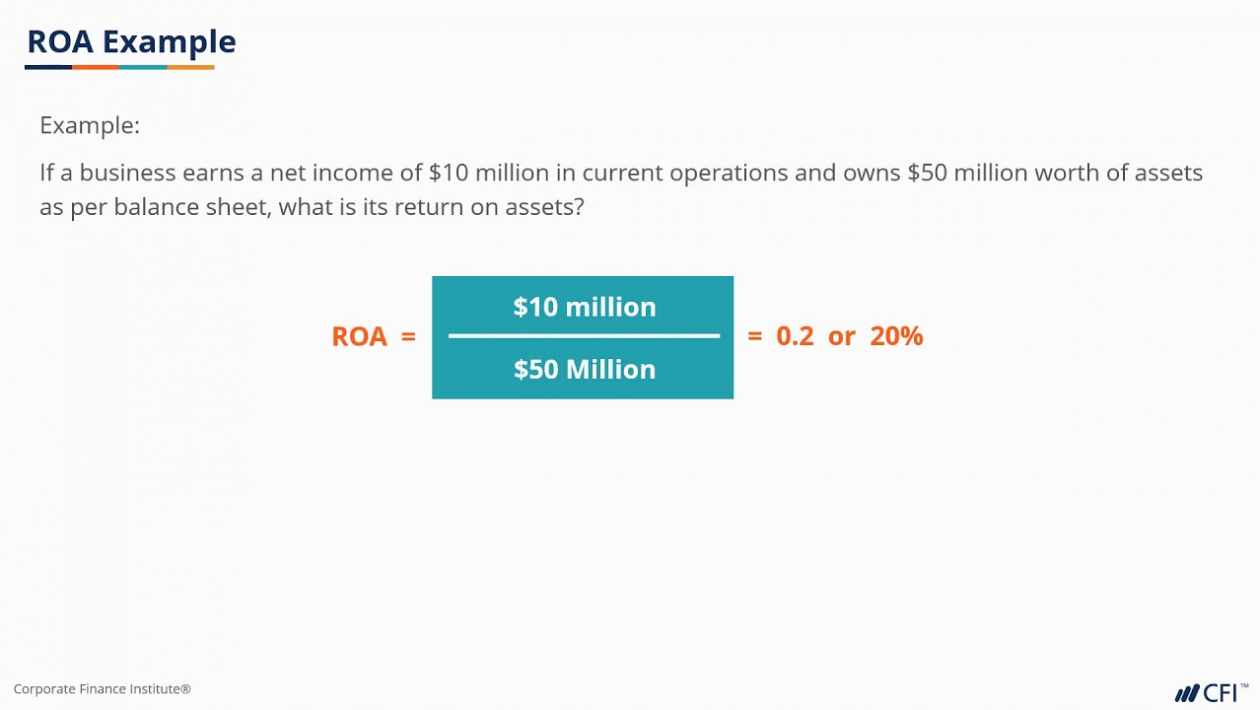

The simple formula to count ROA is below. ROA = (Net Income) / Average Total Assets Before we go any further, it’s essential to know all these words. Because they have particular financial definitions. You can earn the income over time. You can not point net spending and taxes to net income.

It can cover the debt interest, government income taxes, and other unnecessary costs. Cost of goods, marketing, and payment are all examples of operating expenses. The average of tangible assets at the beginning and end of the time under review is the Average Total Assets.

Before going, there is one thing we need to worry about. Some of you may want to know why we are using net income instead of Net Operating Profit after Tax. The reason is that this system allows the equity owner to all the company’s properties. Let’s take a look at it from a different view by discussing three terms.

Equity Value

Equity value is the highest value of the company’s assets that are only open to equity owners.

Enterprise Value

Enterprise value is the market value of only fundamental company properties. Besides these properties are open to all investors. As we need to match the income statement item to the balance sheet, we can pair Net Income with Total Assets. NOPAT contains some payments that are available to all financial analysts. It is a good idea to use it. We can, moreover, explain the return on assets formula by dividing it into two sections.

ROA = (Net Income / Revenue) VS (Revenue / Total Average Assets)

A company can gain a high profit on investment. Because the company increases total sales using its capital. They will use it for development. You need to find a corporation with a 30 percent return on investment. Some investors can choose to profit by 6%. Many resources can turn overpowered by the return on assets formula. Investors can charge if a business is doing better or worse.

How to calculate return on assets formula using net income and total assets

Follow these steps to calculate a company’s return on assets. So that we can know the company’s net income and total assets:

- Find the company’s net income.

- Find the company’s total assets.

- Divide net income by total assets.

Find the company’s net income

The first step is to identify its net profits. You deduct the amount of gross revenue as net profits. The bottom of a company’s income statement contains this thing.

Find the company’s total assets

The following step is to identify the total number of assets or average total assets of the company. A company’s total assets can change. So, using the average real help for your estimate may result in a correct calculation. The balance sheet of the business contains this stuff.

Divide net income by total assets

Finally, count the list of the company’s net income. Then calculate total assets by dividing the net income by the whole capital. To make the equation simpler, round the numbers for net income and total assets if necessary. To show the company’s return on investment, change the result to a percentage.

Return On Assets formula Analysis

The return on assets equation is a ratio. This ratio can display a company’s management’s performance development and growth. This formula isn’t ubiquitous among investors. Because it considers total assets rather than net assets.

Profits are more important to them. Particularly liabilities and assets often balance each other out. As a result, businesses often use the ROA. It provides them with a clear understanding of their progress.

They will also get an idea of how much they use their money. Industries are more likely to use this metric as a key indicator. Service-based sectors with a higher capital focus would have a lower ROA.

Moreover, organizations can use the ROA equation to contrast their rate and rivals. The rates will change from one industry to another. So, you should look at two organizations inside similar industries with comparable resources.

Importance of return on assets formula (ROA)

ROA is a complex thing to the development of business tasks of a firm. It is a more big idea than ROE and ROIC. A growth in ROA indicates that enough is being produced for all partners against ROE. which makes plenty for Equity Shareholders.

Moreover, ROIC thinks about investors and banks. while disregarding current liabilities used to finance tasks. It tells how much return has been created through all capital utilized. You can view a reduction in ROA as a warning.

Also, the administration of the firm should attempt. So that uncover the hidden purpose behind this decay. ROA offers investors a good picture of the board’s potential to enjoy the money they invest in. Besides, the calculation provides a clear image of net edges. And resource turnover, two critical execution drivers.

ROA makes the task of reviewing a company much more accessible. When it assisting financial supporters in separating high-quality stocks from low-quality stocks. Like other productivity proportions, it doesn’t make any difference. if value or obligation supports them. Although their speculation’s profit inspires investors.

The executives are more worried about all the firm’s resources. These resources convey to create returns. Firms also use ROA inside to screen resources. Use over the long run to filter the company’s resource arrangement skill on its friends. It likewise offers experiences into various tasks or divisions’ skills.

This process contrasts them one with the other. Another use case for ROA includes surveying the advantages. putting resources into another task versus. extending the extent of conveyed resources.

Important setbacks towards ROA

Many analysts consider ROA as the best tool to check a company’s achievement. So, it does have its share of problem sets, as discussed below. You use ROA to analyze organizations working in a similar industry.

A few industries are resourceful, like planes and assembling. while some are resource-light like innovation and counseling. But it would not bode well. So you analyze ROA across areas given. That the resource organization rate will up and down. A few examiners will wish on what the correct equation for ROA ought to be.

Even though we already simplify why profit is the right Income Statement metric to use. Many varieties of this equation have. According to an investigation, 11 recorded types of the ROA tools exist across various monetary course books. This investigation examined 77-course readings to agree on the most generally utilized variety.

Furthermore, 40% of reading material shows the things we have spread out before. ROA was the most elevated for any of the varieties checked. You can add ROA to control by the executives to get wanted outcomes.

For instance, bookkeeping devaluation influences the gain. The company finds on a judgment. Another situation could be when the administration has recently collected the old things. And there is a considerable amount of charge, which could influence on gain.

A few examiner’s desires that you can restrict ROA in its applications and bodes well. As a result, you select areas like banks. Banking financial records better address the fundamental idea of their liabilities. Besides, they bear the market esteem, employing imprint to-showcase bookkeeping.

How do you find “what is a good ROA”?

It is critical to assess a company’s ROA opposite its competitors. For Deere, that would incorporate Caterpillar and Paccar. Besides these lines, we should feel free to pull the ROAs for every significant part of the area. That will give us thought about who is bearing their resources most. In this way, as we can see from the total profit.

Deere isn’t the famous organization in the business taking everything into account. Paccar has the highest ROA for this area with a perusing of 6%. Caterpillar. It advises us that for each $1 Paccar puts into its resources, and you can recover 6 pennies as net benefits.

The prior two quarters for 2020 have been challenging for all participating ventures. As it is clear from the graph above. The lockdown implied that assembling organizations needed to stop creation lines. These lines have contributed to a drop in ROA in 2020. Before you go ahead, you need development to return at a much slower speed.

And then, we can expect a couple of quarters of a reduced ROA from this area. Allow us likewise to show the ROA metric for another industry. If the companies were to take a gander at ROA for innovation organizations, the qualities would be higher than the three modern producers.

It is because innovation is tolerable “resource-light” difference with industries. We can see that organizations have a higher ROA. It differs from the industrials comp set. Facebook is, by all accounts conveying its resources most, trailed by Microsoft.

The Bottom Line

You express profit on capital as a percentage. It is a measure for valuing how well a company has done over time compared to competitors. A higher return on total capital indicates that a business is more profitable. Besides, it can better lift any new investment. You can usually use it to compare companies of similar size in the same field or sector.