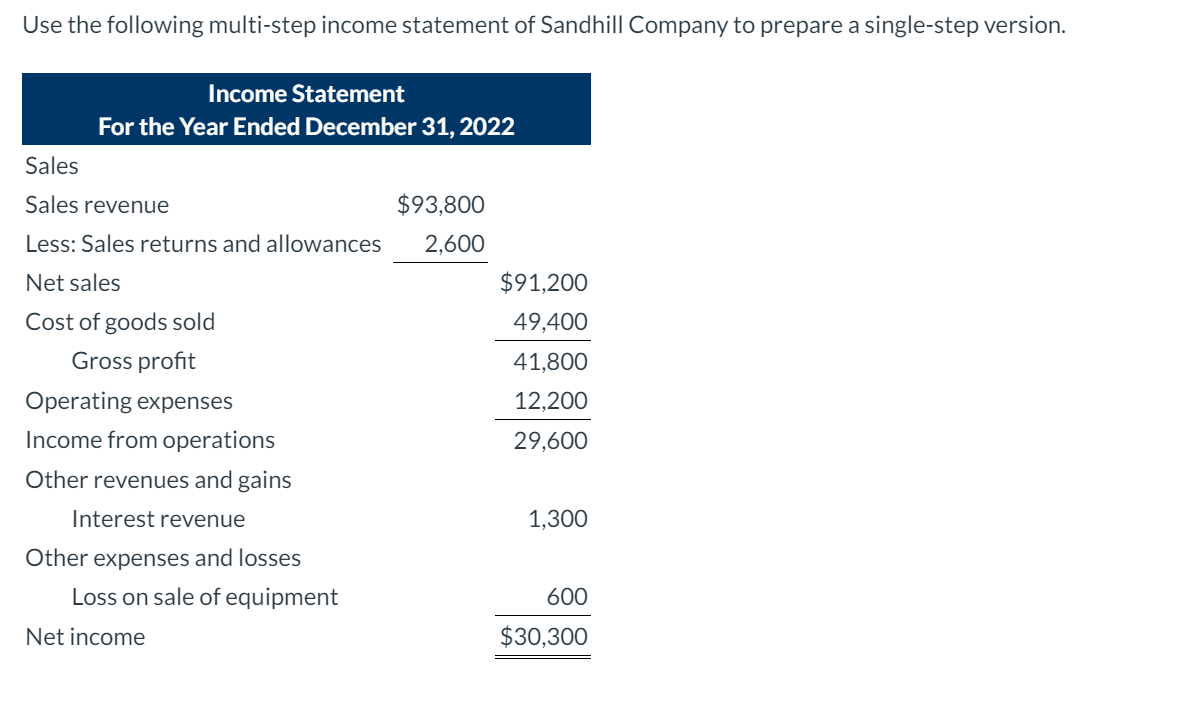

Table of Contents

Introducing multiple step income report

The term multi step income statement denotes an industry’s gains or losses. We study it for a specific time. Besides, it offers an in-depth inquiry into the financial performance of a company. Also, this report sets apart the operating costs and revenues. These are from the non-operating expenses and revenue. It states the way of profit by a company. But, this report is different from the single information in the case of net income. The single-step income statement contains a single calculation. Besides, the multi-step income report needs multiple counts to get the final result. They also find out the operating income and the gross profit. But, it is only for the multi-step income report. It is not for a single account. The single info only can offer the simplest financial deeds and their results.

The multi-step income report offers good aspects. But, it can distort the economic system without research. It is a must to have a fixed check. Else, you may face a lot of problems in the end. So, check it time-to-time.

Multi step income statement- operating section

Income and costs are the critical points of the operating section. Here is in detail about them.

Revenue

Revenue is the cash inflows and other raises of assets to a fixed extent. The resources can come from many sources like making goods, executing many services, and other significant active actions. Mostly, the subtraction of discounts, grants, and returns from direct sales is the revenue. A person may gain income every time he sells some goods or does any work. You can denote the payment as the sales revenue or gross revenue of your business.

Expenses

Expense is the cash outflow of a business. Also, it may be the use of any asset during a fixed time. But, this timespan may include production and delivery or carrying out the core operation. The overall expenses may consist of sales, selling costs, general and office fees, R & D costs, and depreciation.

- The cost of sales denotes the direct expenses. These costs may be in the time of producing the goods, trade, and selling. It includes labor cost, material cost, absorption cost, publicity costs, R & D, or selling costs.

- The selling expenses contain salaries, commissions, travel costs, shipping, freight, advertising, and depreciation.

- The executive and general expenses may include the officials’ salaries, insurance, utilities, office supplies, and office rents.

- Depreciation is one kind of lucid and total sharing of expense. It is also a vital part of overall costs.

- The R & D expenses include all kinds of costs for the research and progress of the goods.

Multi step income statement- non-operating section

The non-operating section contains other gains and losses, finance costs, and income tax costs.

- The unusual gains and profits are a vital part of the non-operating section. These incomes may come from patents, rents, or goodwill. On the other hand, unusual costs or losses may come from foreign exchange losses.

- Tax payment is a prime sector of costs for any business. The finance cost may include bank charges.

Steps of the multi step income statement

The multiple step income statement alternates the single-step income report. Besides, it uses some subtractions to calculate the net earnings. Also, it shows the gross revenue. To find out the net income, you will need to follow three steps.

- Firstly, you have to subtract the products’ cost from the net sales to get the gross profit. That means,

Gross Profit = Net Sales – Expense of Sold Goods

- Then, subtract the operating costs from the gross profit and will get the active income. That means,

Operating Income = Gross Profit – Operating Expense

- Finally, add the non-operating items with the active income to get the final net income. That means,

Net Income = Non-Operating Items + Operating Income

Example of a multi step income statement

Let us make a multi-step income report with a good example.

Suppose the total sales of a company are $50,000,000 and the cost of the sold products is 40,000,000. Besides, the total operating cost is $5,200,000, and the total non-operating and other income is $500,000.

The formula for getting the gross profit is subtracting the sold product’s price from the total sales.

So, the gross profit = $50,000,000 – $40,000,000 = $10,000,000.

Again, getting the operating income is to subtract the total operating cost from the gross profit.

Then, the operating income = $10,000,000 – $5,200,000 = $4,800,000.

Also, Net income = The operating income + Total of non-operating and other income.

So, the net income for this example is $4,800,000 + $500,000 = $5,300,000.

Components of the multi step income statement

The multiple step income statement has two main parts. They are the operating head and the non-operating head. Some details are here,

Operating head

The operating head has two types. They are the followings,

Gross Profit

The first section of an income report is the gross profit. It is the deduction of costs of sold goods from the entire sales. Besides, it shows whether the company and the business are gainful or not. So, investors can take different decisions to invest by investigating the gross profit. Also, it is the calculation between only the cash inflow and the cash outflow.

Selling and Admin Expenses

The second segment of the income report captures the section of admin and selling expenses. The expenses during selling products and costs for marketing, salary, and other charges are the selling costs. On the other hand, the rent and own benefit are the admin fee of a company.

Non-operating head

There should be some extra expenses and incomes in business. But, they have no relation to its main actions or the firm. The non-operating head section deals with these incomes and costs. For example, a company has claimed payment from an insurance company. Then they have won and got the money. So, this money will be one kind of non-operating income. Thus, the net income of a company will be the summation of operating and non-operating income.

Businesses that use the multi step income statement

Complex and large companies use this statement for their business purpose. But, small and direct businesses use the single view as they have direct operations and accounting. Suppose a company deals with different revenue sources. So, it should create and use a multiple-step income report. The openly traded companies need more financial accounts in detail. So, they use multi-step income reports to disclose their earnings.

Advantages of the multi step income report

There are mainly three benefits of using the multi step income statement. These benefits are here,

- The multi-step income report states the amount of gross margin clearly. The readers may monitor and compare the gross income of a company for several years. Thus, they get a short and simple idea about the company or business.

- This report denotes the total operating income. It also indicates the company’s profit. However, this income comes from the initial actions of selling.

- The multiple-step income report denotes the positive net amount as the net income. On the other hand, it states the negative net amount as the net loss.

Multi-Step vs. Single-Step Income Statements

A single-step income report calculates the net earnings of the business by using a single and modest equation. Also, this report is more direct if you link it to a multi-step income statement. Besides, it offers the business’s costs, revenue, loss, or profit during a specific time. But, it deals with a single equation for calculating the gains. The equation is as follows:

Net Income = (Gains + Revenue) – (Losses + Expenses)

Besides, a multi-step income report deals with a method having three steps. These steps help to compute the net income. It isolates the real costs and gains from the non-operating profits. But, it splits the expenses and profits from actions related to the business acts from actions. Also, they have no direct link to the steps.

Multi-step income reports are worth the effort

A contractor or a sole owner can use the single-step income report. But, for a famous and tricky business, a multi-step income report is worth it. Besides, a single-step income statement cannot handle the density of a renowned company. So, you can use accounting software.

How to prepare a multi step income statement

The design of a multi-step income statement is more rigid than the single one. Here are some of the steps of making the income statement.

Selection of the reporting period

Firstly, select a time to report before making the income report. Mostly, these reports are for one month, three months, or one year. Law states that publicly traded companies should make a quarter or annual financial statement. But, monthly reports may help you to notice the profit change of every month.

Generating a document header

Create a file header of the income report. So, the reader can get exact facts about your company from it. It may state your company’s name and will define your reporting time.

The addition of the operating profits

The top part of your income report covers the entire operating actions of your company. Firstly, add the operating profits. It comes from the service or selling of goods.

The addition of the operating expenses

Secondly, add the operating costs with the active actions segment. It includes prices of the sold products and other charges.

Calculation of Gross profit

Subtract the costs of goods sales from the net trades to get the summation of the gross revenue. Besides, add the last number as the line point below the sold product’s cost. After that, rename it as the Gross Profit.

Calculation of the operating Income

After that, calculate the operating income by subtracting the operational costs from the gross revenue. Then put the last calculation as the line point below the active actions part. Give a title like income from operations.

The addition of the non-operating expenses and revenues

Create a new section below the operating actions section to include the non-operating deeds. Add the non-operating costs and profits in this section. Also, you can add the purchase and sale of investments in this part.

Calculation of the Net Income

This step is the final step where you may calculate the net income of your business. Add the non-operating items with your operating income. After that, place it at the bottom section of the multi-step income statement as the net income.

Wrapping up with multi step income statement

The income report with many steps isolates the total costs and revenue. Besides, it creates functional and non-functional heads. Also, this report deals with an in-depth study. This study is about the business’s fiscal performance in a fixed time. But, it classifies all the items differently. Thus it makes the report fit for any user.

Moreover, they can know the income report and the crucial actions of the business better. The users will be able to gain enough insights into the company’s primary business needs. Besides, they will know the revenue generation and affect costs. Then, they may compare the non-primary business actions’ act. This income statement is the substitute to the income statement with the single-step. But, it is apt for elaborate and complex business plans.

The multi-step income report offers enough detail. But, it can mislead if the preparation is not correct. For instance, the management may shift the expenses out of the total cost of sold goods. Also, the operations may improve their margins. Generally, it is vital to check the relative economic reports time-to-time. You may see the trends. And also catch the false placement of costs.